In business one stands by one’s reputation. Trust, the assured reliance on the character, ability, and truth of an individual or business is a vital part of the mutual confidence in any business relationship. Trust was maintained in the City of London over 200 years ago by means of ‘Brokers' Medals’ and ‘Stockbrokers' Tokens’ to prove a trader’s bona fides.

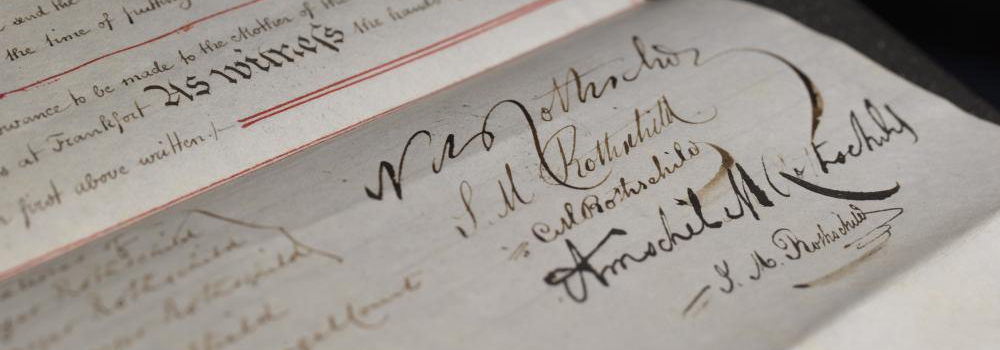

Nathan Mayer Rothschild (1777-1836), left Frankfurt in 1798 and travelled to Manchester in England to take advantage of the revolution in the English textile trade. In 1806, he married Hannah Barent Cohen (1783-1850) the daughter of a wealthy London merchant, and moved his family to London, to focus on the business of merchant banking. Nathan's London house, N M Rothschild, dealt in bullion and foreign exchange, issuing loans and providing banking facilities for a circle of clients.

Brokers’ medals

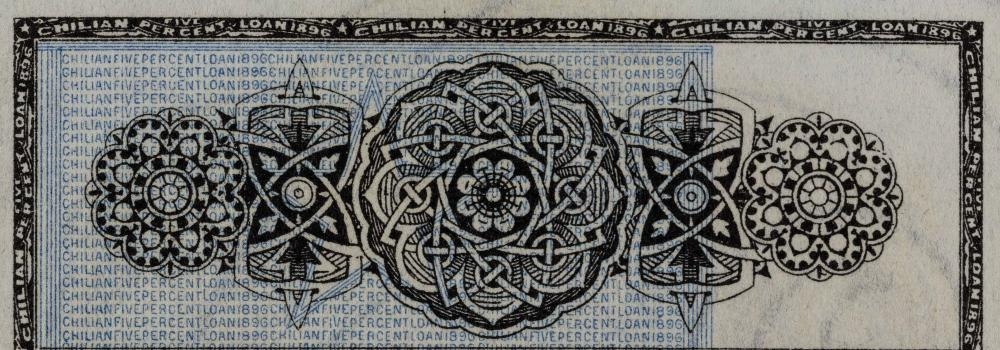

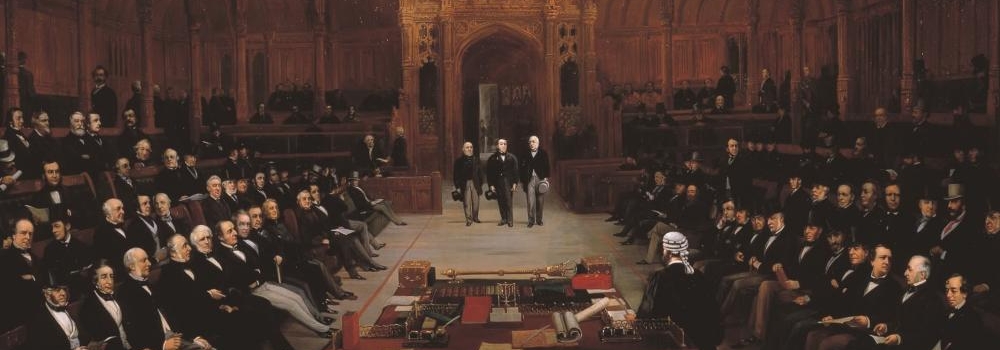

As far back as the end of the seventeenth century it was deemed necessary that stockbrokers should be under some definite license and control to ensure that business was conducted fairly and honestly. In 1696, the Broker’s Act was passed, “An Act to restraine [sic] the Number and ill Practice of Brokers and Stock-Jobbers”. The preamble to the act stated "Whereas divers brokers and stock jobbers have lately set up and carried on most unjust practices, in selling and discounting tallies, bank stock, bank bills, shares and interest on joint stock, and other matters, and have and do unlawfully combine to raise or fall the value of such securities, for their own private advantage; and whereas the numbers of such brokers and stock-brokers are very much increased in these few years, and do daily multiply; be it enacted that from and after May, 1697, no person shall act as broker until licensed by the Lord Mayor and Court of Aldermen of the said City of London." The number of brokers was limited to one hundred, and their names were to be publicly affixed on the Royal Exchange, in Guildhall, and other public places in the City. Any person not being a sworn broker, acting as such, was subject to a hefty fine, (as were their clients) and for every offence to stand three times in the pillory.

This Act continued in force for ten years, and, on its expiry in 1707, the complete control of stockbrokers was granted to the City by Queen Anne. The City now required the stockbroker, before admittance, to be recommended by six merchants of London, to produce certificates of his knowledge and capacity, to promise that he would not ask more than the usual brokerage, and that he would keep a broker's book recording all contracts. He must also, in accordance with the general rule governing all trades in the City at this period, be a Freeman of it. In addition to the license, the newly-fledged stockbroker was presented with a silver medal, engraved with his name, to be produced, when required, as a proof of his bona fides. These medals bear upon one side the Royal Arms, and upon the other those of the City of London, beneath which latter is a space for the recipient's name.

Stockbrokers’ tokens

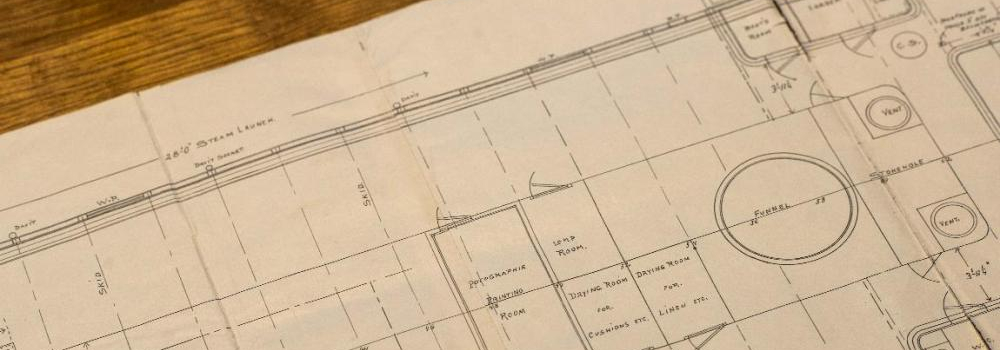

In the collection of The Rothschild Archive is an example of a token circulated by a Stockbroker. The first ‘Stock Exchange’ was situated in Sweeting's Alley, a narrow passage, long since demolished, at the eastern end of the Royal Exchange. Dealers in stocks and shares migrated there from Jonathan's Coffee House in Change Alley in 1773. Tokens were issued by licensed stockbrokers as an advertisement of the firm issuing them, and often were engraved with information about the hours of business and of the days upon which this could be transacted. The token in the Archive collection was issued by “John Ashby, Stock Broker, 3 Bartholomew Lane, Bank”, probably around 1824, shortly after John Ashby was admitted as a member of the Stock Exchange.

On one side the token gives his name and address, and the figure of a bull with a human head. The head bears a striking resemblance to the likeness of Nathan Mayer Rothschild. The reverse lists the “Fix’d holidays” and hours of trading and the figure of a bear with a human head, a representation of the financier Moses Moccatta. The choice of these images was not random; in 1824, Nathan Rothschild, after a mere ten years in the City was established as the founder of the market in Foreign Government Bonds (a market conducted in the Royal Exchange until 1823 and was merged with the Stock Exchange in 1828). Moses Mocatta was a partner in the banking and bullion broking firm of Mocatta & Goldsmid, which can trace its origins back to 1671. Rothschild and Mocatta were representative of the power of Jewish financiers at that time, and the use of their likeness was meant partly as a tribute to their success and partly to reflect well upon Ashby, although there is no direct link between the House of Rothschild and Ashby’s business.

The ’Bull’ and the ‘Bear’ are familiar terms to those in the finance business, used frequently to refer to market conditions. These terms describe how stock markets are doing in general - that is, whether they are appreciating or depreciating in value. A bull market is a market that is on the rise and where the conditions of the economy are generally favourable; a bear market exists in an economy that is receding and where most stocks are declining in value. The origin of the terms in unclear; one theory is that they come from a rather grisly bloodsport – popular in both Elizabethan England and gold rush era California – in which a bull would be pitted against a bear. Spectators would bet on the outcome. Bulls came to represent a rising market, because when bulls attack, they thrust their horns upwards, whereas when bears attack, they claw downwards. Another theory is that the term ‘bear’ originated with the market for bearskins; middlemen in the trade would sell skins before they’d bought them from trappers, in effect, short-selling.

1824 – an important year

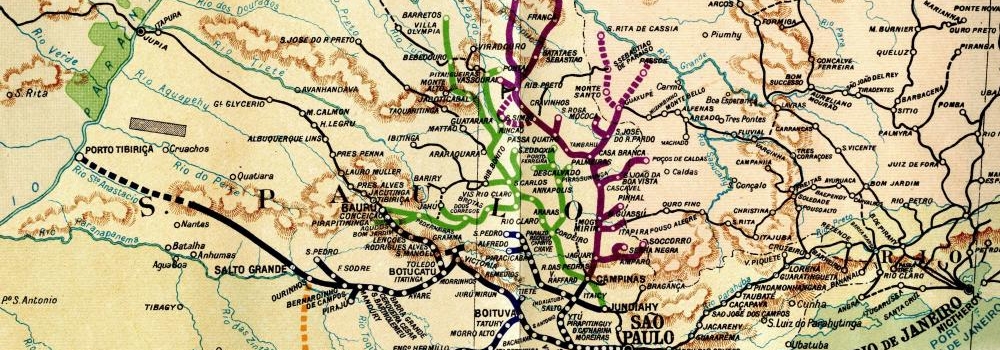

The period at which John Ashby issued his first token is a very interesting one, as the speculative fever that arose in 1824 was the means of greatly enlarging the number and scope of the companies quoted on the Stock Exchange; this period was also remarkable for the first appearance of mining companies in any number. The year also saw the creation of the Alliance Assurance Company. The story goes that the financier Moses Montefiore and Nathan Rothschild – married to sisters, and neighbours in St Swithin’s Lane in the City - fell into conversation one day as the latter was going to collect the dividends on shares he held in an insurance company. The two men agreed that with their many friends and contacts they themselves could supply a useful number of clients for any insurance company and saw the advantages of setting up a new company themselves. Nathan and Moses resolved to form an insurance company to rival and circumvent Lloyds, with a larger share capital and a more influential Board of Directors. The plan was quickly put into action. Joining Rothschild and Montefiore as founding presidents were the prominent Quaker, Samuel Gurney, and the financiers John Irving and Francis Baring. The Alliance British and Foreign Life and Fire Assurance Company Ltd commenced business on 23 March 1824 in temporary offices in Moses Montefiore’s home in St Swithin’s Lane. It was started with a capital of £5 million, enormous for the time. The Company later moved to 1-2, Bartholomew Lane in the City - the same street as John Ashby.

RAL 000/956 Stockbroker’s token of John Ashby, c.1824