Origins

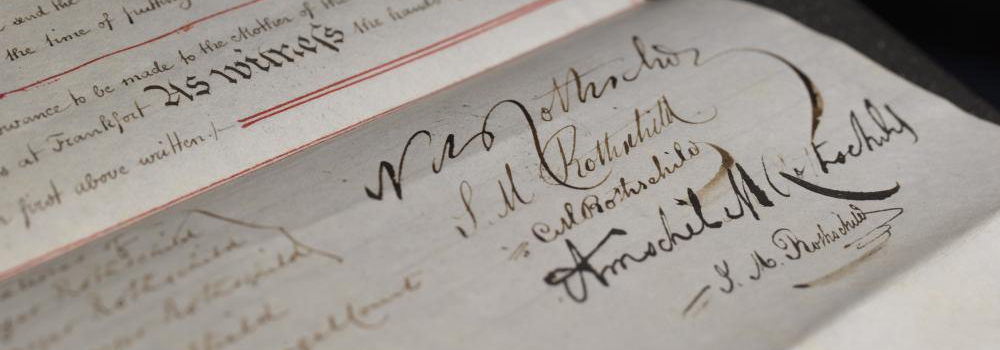

Nathan Mayer Rothschild (1777-1836) arrived in Britain in 1798. In 1799, he made his first home in Manchester, the centre of the English cotton trade, and set up a cloth wholesale business, part of his father's attempt to extend the family's trade in English printed textiles. Encouraged by his success, Nathan then moved to London to establish himself as a banker, establishing N M Rothschild at New Court, St Swithin's Lane in the City in 1809. By 1811 he had wound up the Manchester wholesale business to concentrate on banking. Since 1809 there has been a succession of four buildings called 'New Court' on the site originally chosen by Nathan Mayer Rothschild. Read more about the history of New Court »

Early business

Temporary access to funds, invested by the Rothschild House in Frankfurt for William IX of Hesse-Cassel, greatly increased the scope of Nathan's London operations. These were based upon profitable speculation in British and foreign securities, and prominent dealing in foreign exchange and bullion. By 1814, Nathan was placed uniquely to fulfil the prestigious British Government contract to purchase and transport gold coin to finance Wellington's army on the Continent. After the latter’s victory at Waterloo, the London House won a further contract to handle English subsidy payments to the European allies. Read more about the Waterloo Commission » The position of Nathan Rothschild as the leading City merchant banker was consolidated in 1826, when the firm stepped in, with an instant injection of gold, to save the Bank of England. Read more about Rothschild and gold »

N M Rothschild & Sons

With Nathan’s death in July 1836, the City of London lost a financier whose name had become legendary in his own lifetime. However, N M Rothschild & Sons would continue to prosper at the centre of the London financial world under Nathan's son, Lionel Nathan de Rothschild (1808-1879). Apprenticed in the family business in London, Paris and Frankfurt, he was admitted to the family partnership in 1836 and under his direction, business grew; the traditional clutch of sovereign clients was nurtured and extended. Lionel is remembered in business for his assistance to the British Government in 1875, helping his friend, Disraeli, secure the necessary sum to procure the Khedive of Egypt's share in the Suez Canal. Read more about the Suez Canal Purchase loan »

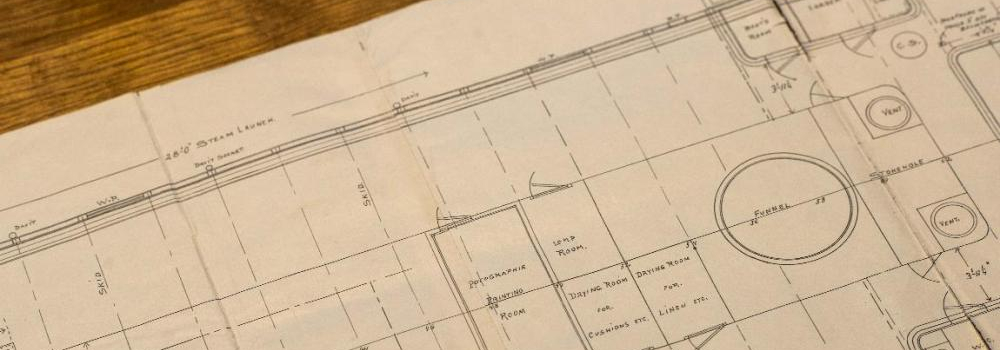

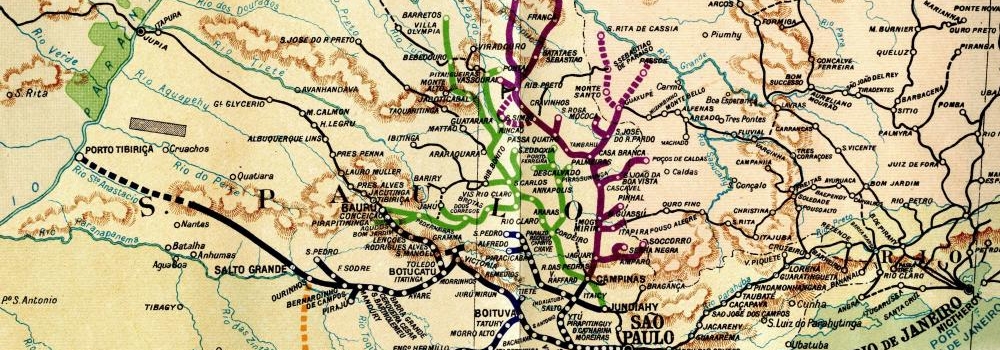

The business specialised in foreign loan issues, bullion trading and the finance of public utility companies, notably foreign railways, while maintaining in the first half of the nineteenth century a certain volume of merchant trade in commodities such as quicksilver, tobacco, sugar and cotton. The London house was noted for the many loan issues the business handled; Jules Ayer published a list of these in A Century of Finance, (William Neely, London: 1905).

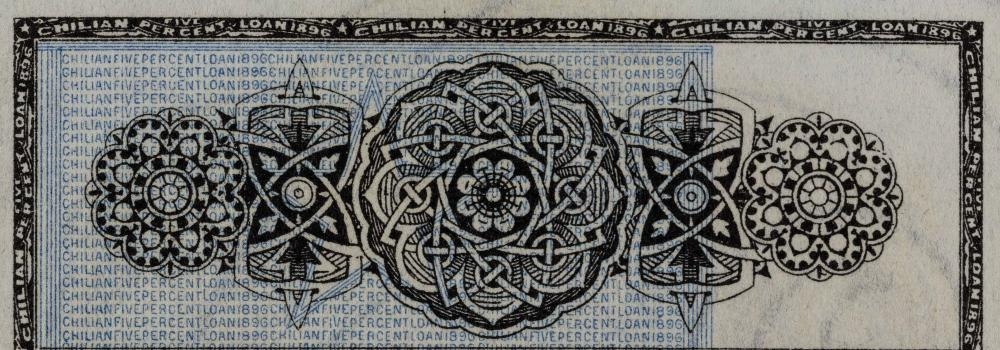

The firm operated through a worldwide network of agents, among them August Belmont (New York, est. 1837), Weisweiller & Bauer (Madrid, est. 1835), Lionel Davidson (Valparaiso, est. 1843), and S Bleichröder (Berlin, documented from 1850). The firm acquired the lease of the Royal Mint Refinery in 1852, refining bullion until the sale of the business in 1967. In the late nineteenth century N M Rothschild and Sons specialised in the finance of mining companies, notably De Beers, through the Exploration Company of which the bank was a founder, and also acted as bankers to the governments of Brazil, Chile and Egypt.

Nathan's descendants Lionel Nathan de Rothschild (1808-1879), Nathaniel, 1st Lord Rothschild (1840-1915), Alfred de Rothschild (1842-1918), Charles Rothschild (1877-1923), Lionel Nathan de Rothschild (1882-1942), Anthony Gustav de Rothschild (1887-1961) and Edmund de Rothschild (1916-2009) continued the business under the name N M Rothschild & Sons. The first non-family partner was admitted in 1960 and the firm was incorporated as a limited liability company, N M Rothschild & Sons Limited, in 1970.

Rothschild & Co.

In 2003, after 44 years with the family firm, Sir Evelyn de Rothschild (1931-2022) stepped down as Chairman of N M Rothschild & Sons Limited. The appointment of David de Rothschild as the Rothschild Group Chairman brought together again the English and French Rothschild business houses, with the merger of N M Rothschild & Sons Limited with Paris Orléans SA.

In 2011, the firm rebranded from N M Rothschild & Sons Limited to Rothschild & Co. In 2015, the parent company of the Rothschild Group, formerly known as Paris Orléans changed its name to Rothschild & Co. to match the trading name of the business. The Compagnie du chemin de fer de Paris à Orléans was founded in 1838 as a railway company; after the Second World War, the French branch of the Rothschild family transformed it into a holding company for its banking activities. In 2018, Rothschild & Co announced the appointment of Alexandre de Rothschild, son of David de Rothschild, as Executive Chairman of the group. Today Rothschild & Co. is one of the world’s largest independent financial advisory groups, providing strategic, M&A, wealth management and fundraising advice and services to governments, companies and individuals worldwide.

List of the family members who have led the London business.

N M Rothschild

Nathan Mayer Rothschild (1777-1836) [1]

1809-1836N M Rothschild & Sons

Baron Lionel Nathan de Rothschild (1808-1879) [2]

1836-1879Nathaniel Mayer, 1st Lord Rothschild (1840-1915)

1879-1915Alfred Charles de Rothschild (1842-1918)

1915-1918The Hon. Nathaniel Charles Rothschild (1877-1923)

1918-1923Lionel Nathan de Rothschild (1882-1942)

1923-1942Anthony Gustav de Rothschild (1887-1961) [3]

1942-1960Edmund Leopold de Rothschild (1916-2009)

1960-1970N M Rothschild & Sons Limited

Edmund Leopold de Rothschild (1916-2009) [4]

1970-1975Victor, 3rd Lord Rothschild (1910-1990)

1975-1976Sir Evelyn de Rothschild (1931-2022) [5]

1976-2003Notes:

[1] Nathan was active in England from 1798, when he first arrived in Manchester, co-ordinating activity on behalf of the family business. In 1809, he establshed N M Rothschild at New Court in the City of London.

[2] After the death of his brother Nathan in 1836, James took over the reins of the family firm. In 1838, Lionel, Nathan's son succeeded in modifying the Partnership Agreement to retain the relative autonomy of the London house. By the early 1840s, the resources of the London, Paris and Frankfurt houses were evenly matched.

[3] Rothschilds Continuation Ltd was formed as a second corporate partner of N M Rothschild & Sons in 1941 to ensure the continuity of the firm’s business during the Second World War.

[4] The senior Rothschild directing the London business was known as the Senior Partner until 1970, when the title Chairman was adopted when N M Rothschild & Sons became N M Rothschild & Sons Limited.

[5] Sir Evelyn de Rothschild stepped down as chairman of N M Rothschild & Sons in 2003. The appointment of David de Rothschild as the Rothschild Group Chairman brought together again the English and French Rothschild business houses, with the merger of N M Rothschild & Sons Limited with Paris Orléans (the holding company of the French Rothschild family for its business activities). In 2011, the firm rebranded from N M Rothschild & Sons Limited to Rothschild Group. In 2015, the firm rebranded again, to become Rothschild & Co. At the same time, the parent company, formerly known as Paris Orléans, changed its name to Rothschild & Co. to match the trading name of the business. In 2018, Rothschild & Co announced the appointment of Alexandre de Rothschild, son of David de Rothschild, as Executive Chairman of the group.